Master in Accounting (MAcc)

N/0411/7/0011 | MQA/PA 17741

- Complete in 15 months

- Physical & online classes (non-working hours)

- Affordable fee

Programme Overview

The AMC UC Master of Accounting (MAcc) program offers a comprehensive and industry-focused curriculum designed to equip professionals with advanced financial expertise and strategic decision-making skills. This program integrates core accounting disciplines with practical applications, culminating in a research-driven thesis project to enhance real-world problem-solving abilities.

Learning Objectives

- Equip students with advanced theoretical and practical knowledge in accounting, financial reporting, auditing, and taxation.

- Develop strategic decision-making and leadership skills to manage financial operations across industries effectively.

- Enhance proficiency in digital accounting tools, financial analytics, and regulatory compliance to support business functions.

- Foster teamwork, interpersonal communication, ethical judgment, and critical thinking for effective problem-solving.

- Encourage a commitment to lifelong learning and professional development in the evolving field ofaccounting and finance.

Programme Module

Year 1:

- Managing Performance

- Advanced Management Accounting

- Advanced Financial Reporting

- Advanced Auditing

- Strategic Management

- Risk Management

- Financial Strategy

- Ethics & Governance

- Strategic Human Resource Management

- Business Research Method

- Advanced Taxation

- Accounting Information System

Year 2:

- Research Project

Graduate Credit

42 credit

Mode of Learning

Coursework – Full Time

Duration

1 Year 3 months

Entry Requirements

- A Bachelor’s Degree (Level 6, Malaysian Qualifications Framework, MQF) in Accounting or related fields with a minimum Cumulative Grade Point Average (CGPA) of 2.75 as accepted by the Higher Education Provider (HEP) Senate; OR

- A Bachelor’s Degree (Level 6, MQF) in Accounting or related fields with a minimum CGPA of 2.75 and not meeting CGPA of 2.50 can be accepted, subject to a through rigorous assessment by the HEP; OR

- A Bachelor’s degree (Level 6, MQF) in a Non-Accounting field with a minimum CGPA of 2. 50 can be accepted subject to a thorough rigorous assessment as determined by the HEP to identify the appropriate prerequisite courses that are equivalent to their working experience in the related field can be accepted subject to a minimum of 5 years of working experience in the relevant field; OR

- A Bachelor’s Degree (Level 6, MQF) in Accounting or a related field below a CGPA of 2.50, can be accepted subject to a minimum of 5 years of working experience in the relevant field; OR

- A relevant professional accounting qualification equivalent to a bachelor’s degree as accepted by the HEP Senate; OR

- Other qualifications equivalent to a Bachelor’s Degree (Level 6, MQF) recognized by the Government of Malaysia must fulfil the requirement on item i or ii

- English Competency Requirement (International Student):

- Achieve a minimum of Band 4 in Malaysian University English Test (MUET) or equivalent to Common European Framework of Reference for Languages (CEFR) (Low B2).

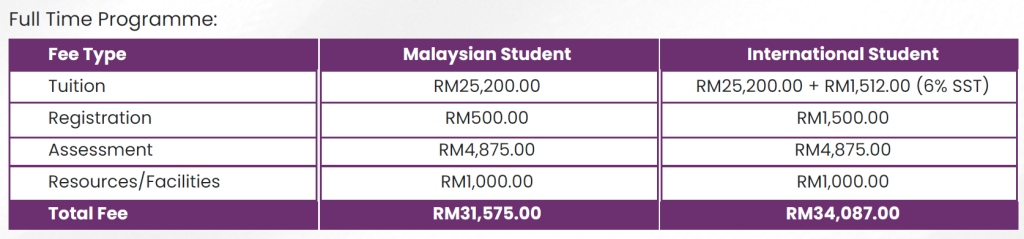

Fee Structure

Share This Post!

← Master Programme